Cronkite News has moved to a new home at cronkitenews.azpbs.org. Use this site to search archives from 2011 to May 2015. You can search the new site for current stories.

Report: High cigarette tax fuels black market in state

PHOENIX – A cigarette tax higher than neighboring states and cheaper prices on American Indian reservations have helped fuel a growing a black market for cigarettes in Arizona, according a study by a Washington, D.C., think tank.

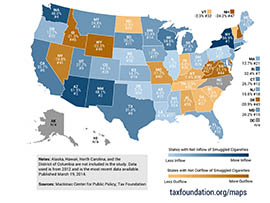

The Tax Foundation, a nonpartisan group that advocates for transparent and broad-based taxation, estimated that smuggled cigarettes made up 51.5 percent of Arizona’s cigarette consumption in 2012.

While Arizona taxes cigarettes at $2 per pack, the taxes in neighboring states range from 80 cents per pack in Nevada to $1.66 per pack in New Mexico. American Indian reservations also are less-expensive sources of cigarettes.

“All this works in concert to make it a very profitable market,” said Scott Drenkard, economist at the Tax Foundation.

Arizona’s estimated percentage of smuggled cigarettes ranked second in the report to 56.9 percent in New York, which had the nation’s the highest tax per pack at $4.35.

The report estimated that smuggled cigarettes accounted for 32.1 percent of Arizona’s cigarette consumption in 2006.

Drenkard said cigarette taxes have created a situation similar to Prohibition, which saw a black market.

“People will find a way to produce it illegally and that market will spring up, much as it did in the ’20s with alcohol,” he said.

The casual smuggler is an individual who buys a pack or two of cigarettes while in another state because of the lower taxes, Drenkard said. That phenomenon is increasingly common in the eastern U.S. where states are close together and there are big differences in excise taxes, he added.

But Drenkard said smuggling can also be more formalized.

“People work in organized fashion to bring cigarettes from low tax areas to a high tax area and profit,” he said.

Drenkard said a burgeoning black market costs states not only tax revenue but the ability to control sales to minors. “That’s against the goals of public policy,” he said.

Adam Chodorow, a professor at Arizona State University’s Sandra Day O’Connor College of Law, said taxes can serve two purposes: raising revenue and discouraging certain behavior. A black market has the potential to cut into revenue that goes toward preventing people from starting to smoke and helping people to quit, he said.

“It’s not clear what would happen if we shut the black market down, if we funneled people back into the regular-taxed system. They might smoke less, in which case we’re not going to raise more revenues,” he said. “They might go out of state to get their cigarettes in places where they have lower taxes.”

In an emailed statement, the Arizona Department of Revenue said the study’s variables could logically produce the results, but it said the report doesn’t match what the department has seen.

“In course of our inspections and other enforcement activity, the Department’s Tobacco Enforcement Unit has not experienced this alleged high level of cigarette smuggling,” the statement said.