Cronkite News has moved to a new home at cronkitenews.azpbs.org. Use this site to search archives from 2011 to May 2015. You can search the new site for current stories.

Bankruptcy court gives final OK to US Airways-American Airlines merger

WASHINGTON – US Airways and American Airlines said they expect to complete their long-planned merger by Dec. 9, after a federal bankruptcy judge on Wednesday removed the final hurdle to the deal.

While the companies will start trading as a single stock that day, under the name American Airlines Group, a spokesman for Tempe-based US Airways said fliers will not notice any immediate differences.

“Customers will not see any changes Dec. 9, but going into the beginning of the year customers will start see the changes,” said Davien Anderson, the spokesman.

The new American Airlines will form in bits and pieces as the two companies work separately and start to merge very slowly, Anderson said.

It would cap months of planning between US Airways and American Airlines, which has been in Chapter 11 bankruptcy proceedings since November 2011.

The two airlines in February formally announced a merger plan that was approved by shareholders in July. It stalled in August when the Justice Department and seven states, including Arizona, filed an anti-trust lawsuit to block the merger, over fears that it would slow competition and drive up costs for consumers.

That suit was settled earlier this month, when the airlines said they would give up gates at seven different airports across the country, including 102 at Ronald Reagan Washington National Airport.

The settlement also requires the airlines to continue service to current markets for several years and to maintain hub operations. In Arizona, that means the hub at Phoenix Sky Harbor International Airport will remain, along with daily service to Flagstaff, Tucson and Yuma.

While US Airways is headquartered in Tempe, the new airline will be based in Fort Worth, Texas.

The settlement still needed to be approved by U.S. Bankruptcy Judge Sean Lane, who ruled Wednesday that the agreement “is fair and equitable and in the best interests of the estate.”

A private antitrust lawsuit is still pending, but Lane rejected a request for a temporary restraining to stop the merger, saying opponents had “utterly failed to establish irreparable harm” if the deal was allowed to go forward.

AMR Corp., the parent of American, will not need to get stakeholders to approve the merger again, Lane said.

In a statement Wednesday, American Airlines said that Friday, Dec. 6, will be the last day US Airways’ stock trades under the symbol LCC and American’s as AAMRQ. On Dec. 9, the merged airlines will trade on the Nasdaq as American Airlines Group Inc. with the symbol AAL.

Current shares of US Airways stock will convert to American Airlines Group stock on a one-to-one basis, according to the merger plan.

“The combined airline will have a strong financial foundation and is poised to deliver significant value to shareholders,” US Airways CEO Doug Parker said in a prepared statement earlier this month, when it was announced that the new stock would trade on the Nasdaq.

Stock for both airlines has increased since last November, when US Airways was trading at less than $13 a share and American was below 50 cents a share. At close of trading Wednesday, US Airways was at $23.98 per share and AMR shares were at $12.25.

There are still issues to be worked out.

A spokesman for the International Association of Machinists said US Airways needs to guarantee machinists their contracts before a deal can proceed, for example. The union is the largest at US Airways, with more than 14,000 members.

“The merger will not happen without getting these contracts done first,” said James Carlson, the spokesman, who said integration of employees will not take place until machinists are satisfied.

Lane’s ruling came the same day that the Justice Department’s Antitrust Division officially posted notice of the settlement of the antitrust suit.

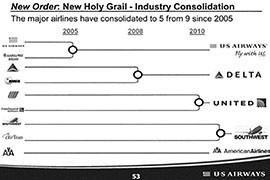

That posting noted that mergers cut the number of major air carriers from nine in 2005 to four after this deal goes through – the new American Airlines, Delta Air Lines, United Airlines and Southwest Airlines.