Cronkite News has moved to a new home at cronkitenews.azpbs.org. Use this site to search archives from 2011 to May 2015. You can search the new site for current stories.

Arizona schools earn B on report card for financial literacy requirements

WASHINGTON – Arizona got a B on a recent national report card that graded states for their efforts to improve financial literacy in high schools.

The July report from the Center for Financial Literacy awarded a B to states, like Arizona, that require high schools to teach some level of financial literacy, but do not require an assessment on the material.

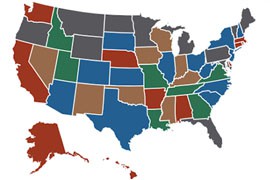

Seven states got an A for requiring an assessment of students’ financial literacy in addition to requiring the subject in the curriculum. Eight states got a C, 11 got a D and another 11 got an F for not having any finance standards in their curricula.

State experts said the rankings point up the importance of the issue.

“The benefit is really enormous. After age 18, students need to make a lot of financial decisions,” including borrowing money, student loans, which school to go to and what major to take, said Elena Zee, president and CEO for the Arizona Council on Economic Education.

The rankings came out before a new state law that codified what had been Arizona Department of Education policy since 2007. The law would not have made a difference in the state’s grade, since it does not require an assessment, but local officials said it is still important to have the law on the books.

Sen. Kimberly Yee, R-Phoenix, who sponsored the bill, said it ensures that personal finance requirements will never be taken out of the state’s education standards. Now, “anytime the state board of education adopts its academic standards they will incorporate personal finance within those standards,” Yee said.

Zee said the Arizona Department of Education “has really excellent personal finance standards in place already,” but agreed that it was important to put the language into law.

“The problem was that was not reflected in the Arizona state statutes,” she said. “It was never outlined that personal finance was required for graduation in the statutes even though the standards clearly state that.”

Chris Kotterman, deputy director of government relations for the Arizona Department of Education, said the law is a “vehicle to draw attention to what is already there” in the department’s standards. He said the law should not affect school districts, as long as they are already teaching the requirements.

Yee said that the law also ensures that all school districts are covering the requirements.

“Some of them are doing it really well and put a great emphasis on it and then some are just touching upon it,” Yee said.

Sharon Lechter, the founder of Pay Your Family First, pushed for the bill with Yee. She said the law brings personal finance to the forefront, at a time when personal finance education is especially important.

“It is imperative, given the current economic climate, that as adults we do whatever is necessary to educate our young people as it relates to financial education so that they are properly prepared for the economic world they face,” Lechter said.

Mike Sullivan, director of education at the credit-counseling service Take Charge America, agreed that personal finance should be taught in schools, but noted that it is also a parent’s responsibility.

“I think one of the things that’s overstated is how much schools should do, and one of the things that is understated is how much the families should do,” Sullivan said.

Lechter said she is happy with Yee’s bill, but plans to continue fighting for a standalone personal finance class statewide. The law currently prohibits the state board from requiring a standalone class, but allows local school districts to take that step locally.

“I’m happy that the law was passed . . . but I want it to be stronger,” she said. “I would like to see the law become a required course of personal finance.”

She said the issue is too important to let it drop.

“Money is a life skill. It doesn’t matter what your choice of profession, everyone has to deal with money,” Lechter said. “Teaching young people at an early age how to make it, how to keep it, how to invest it, how to have it work for them gives them a lifetime of reward, so that they can become masters of their money and not slaves to it.”