Cronkite News has moved to a new home at cronkitenews.azpbs.org. Use this site to search archives from 2011 to May 2015. You can search the new site for current stories.

Arizonans more likely to choose pawnshops when it comes to getting cash

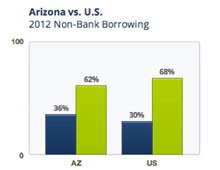

WASHINGTON – Arizonans were much more likely than the rest of the nation to turn to a pawnshop to get cash, according to a survey released this week by the Financial Industry Regulatory Authority, a private nonprofit.

The FINRA Foundation’s Financial Capability report found that 18 percent of Americans reported using a pawnshop within the past five years while 27 percent of Arizonans surveyed said they had done so.

The numbers surprised a state banking official and even a national pawnbroker’s association official. But they came as no surprise to Kirby Brown of Glendale Pawn and Jewelry.

“Thanks to the success of television shows like ‘Pawn Stars’ on The History Channel, those who have no idea what services pawnshops actually provide have become educated and curious about how pawnshops might be of benefit to them,” Brown said.

Another reason for the booming pawn business is not new – the effect of a tough economy on middle-class families, he said.

“People need to get short-term cash,” Brown said, and they do that by turning unneeded items into much-needed cash.

“Some sell items through yard sales and popular Internet bulletin boards such as Craigslist,” Brown said. “But a pawnshop is much simpler and safer.”

He estimated that about 85 percent of pawnshop customers pay back their loans and retrieve their items.

But Paul Hickman said pawnshop loans are not always the best deal for consumers.

“The interest rates for pawnshop loans are relatively high and you may have to pay for the additional fees such as insurance and storage,” said Hickman, the president of the Arizona Bankers Association.

Arizona law lets pawnbrokers collect fees at redemption or renewal, in addition to interest charged, Hickman said, “So you may end up paying $3,000 to reclaim $1,000 worth of collateral.”

Hickman said he does not see pawnshops posing a threat to banks. He said his assumption is that people go to pawnshops because they don’t have good credit, or any credit at all.

Still, Hickman said he was “sort of surprised by the data” on pawnshop business. So, too, was Emmett Murphy, a spokesman, spokesperson for the National Pawnbrokers Association.

“The percentages indicated in the report do not appear to be an accurate snapshot of pawn store use in Arizona or on a national level,” Murphy said. He pointed to a recently released 2011 survey by the Federal Deposit Insurance Corp. that said 7.4 percent of all U.S. households have used a pawnshop.

The FINRA Foundation report was an online survey of 25,509, American adults – about 500 per state and the District of Columbia – over a four-month period in 2012.

“It does give people an option to get money, but it is not a solution for everyone,” Murphy said of the pawn business.

For those who do patronize a pawnbroker, however, Murphy said today’s pawn stores are attractive places to do business. And they’re growing: The association said the number of pawnshops in the country has grown from just under 6,400 in 2007 to an estimated 10,000 in 2012.

Vince Shorb, CEO of the National Financial Educators Council, said he sees a pawnshop as a place to get rid of things you no longer need.

“It is easier to go to a pawnshop than selling it on eBay,” Shorb said. “But I don’t think it’s an effective financial strategy.”

He said knowledge is the key to managing personal finances.

“Sometimes things like interest rates and getting loans can be complex and confusing even for experts,” Shorb said. But is important for people to have some basic knowledge, because that’s what really impacts their daily life.

Whatever the reason, Brown knows one thing: Business is good.

“It is no doubt that the pawnshop has become a primary financial partner for many struggling Americans,” he said.