Cronkite News has moved to a new home at cronkitenews.azpbs.org. Use this site to search archives from 2011 to May 2015. You can search the new site for current stories.

Arizona anticipates a 5 percent increase in tax collections in 2013

WASHINGTON – Arizona expects a 5 percent increase in state tax collections in fiscal 2013, one of just nine states where revenues are projected to rise more than 5 percent, a new report says.

Experts and state officials said the increase reflects the general improvement in the state’s economy and that the 5.1 percent increase may actually be a conservative estimate.

A spokesman for Gov. Jan Brewer said the prediction by National Conference of State Legislatures is “very much in line” with the state’s earlier estimate of a 5.5 percent revenue increase in fiscal 2013.

“We expect it to be even better than what was predicted,” said Matthew Benson, the spokesman.

The conference report released last week included revenue forecasts from all 50 states and the District of Columbia and predicted a third consecutive year of general growth in state taxes.

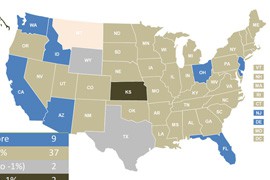

In addition to the nine states exceeding 5 percent growth, 37 jurisdictions will see growth less than that, according to the report. Texas and Wyoming expect essentially flat revenue, while Alaska and Kansas will see declines. Estimates were not available for Montana.

Dennis Hoffman, director of the L. William Seidman Research Institute at the W.P. Carey School of Business, said Arizona’s revenue growth is not completely surprising.

“The state’s economic situation over the last four to five years was depressed, but in the last two years, we have seen increasing signs of growth coming off of this depressed level,” Hoffman said.

“Retail spending levels were in the 5 percent range in the last few months, and will continue into the new fiscal year,” he said.

Todd Haggerty, an NCSL policy analyst who wrote the report, agreed Arizona faced significant challenges in the recession but has since seen a sharp turnaround.

“It’s definitely one of the strengths for Arizona in fiscal year 2013,” Haggerty said. “Especially in the context that Arizona did face some of the biggest budget gaps (during the recession).”

Haggerty said the federal deficit and the looming budget sequestration could still affect Arizona’s revenues, noting that the state is “not necessarily out of the woods yet.”

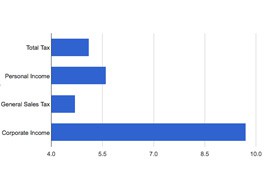

He also cautioned that the state should be looking ahead, noting that the scheduled expiration next May of a voter-approved one-cent increase in the sales tax could affect growth in 2014.

If the sales tax is allowed to revert to its previous level, Hoffman said revenue will “certainly decline” by what he predicted to be $1 billion, which would dampen growth in 2014.

The Arizona Office of Strategic Planning and Budgeting said Wednesday that preliminary numbers for 2012 indicated the state collected $8.7 billion in taxes, $916 million of which came from the temporary one-cent sales tax.

“If we were to retain the one-cent sales tax, we’ll get about 7 percent growth again next year,” Hoffman said.

“Again” because Hoffman believes the state will see revenues increase by 7 percent in fiscal 2013, calling the NCSL prediction conservative.

“My own forecast is growth overall by 7 percent,” he said. ”We will be leaders of those states” whose projections for 2013 topped 5 percent, he said. “Our numbers may come close to 7 or 8 percent and we will be in the top two or three in the country.”

Benson said Arizona’s economic recovery has been slow and steady, but not at all surprising.

“Arizona was one of the first states to go into recession, so it makes perfect sense that we are one of the first states to come out of it,” he said.