Cronkite News has moved to a new home at cronkitenews.azpbs.org. Use this site to search archives from 2011 to May 2015. You can search the new site for current stories.

Sides debate Proposition 204′s effect on jobs, economy

Editor’s Note: Cronkite News Service reporter Sarah Pringle contributed to this report.

PHOENIX – In George Cunningham’s view, Proposition 204 means jobs.

Cunningham, a former Democratic state lawmaker and the volunteer treasurer for the ballot measure’s campaign, said the permanent 1-cent per dollar sales tax would allow schools to employ more teachers and would boost hiring for transportation projects.

“This proposition will be superb for the economy,” Cunningham said.

Proposition 204, dubbed the Quality Education and Jobs Act, would replace a three-year sales tax voters approved in 2010 to fund education through the recession. It would earmark funds for education, transportation and human services, areas that supporters say still need more funding.

But to Glenn Hamer, president and CEO of the Arizona Chamber of Commerce, the measure is really just throwing money at the problem and would lock in an already high sales tax.

“This is being sold as something that will be good for business and will improve educational performance,” Hamer said. “Well, we all know this will be bad for business.”

Hamer said locking in a high sales tax rate would discourage spending.

“The end result is that if they succeed they will hurt the state economically,” he said.

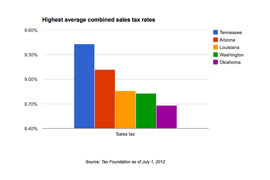

Arizona’s current state sales tax rate is 6.6 percent, but many counties and cities add their own sales taxes.

Arizona had the ninth-highest state sales tax rate as of July of this year, according to the Tax Foundation, a nonpartisan tax research group based in Washington, D.C. But it listed Arizona as second-highest when the state rate is combined with the average local sales tax rate.

Jerry Bustamante, vice president of public policy for the Arizona Small Business Association, said a permanent sales tax increase would encourage consumers to shop online.

“That’s going to hurt local businesses,” he said.

Spencer Kamps, vice president of the Home Builders Association of Central Arizona, said he opposes the measure because it would lock in the current sales tax code, hampering efforts by state leaders to reform the current code.

Gov. Jan Brewer, who opposes Proposition 204, established a task force in May to recommend a way to simplify the sales tax code.

“Arizona has the most complicated sales tax system in the nation,” Kamps said. “It is a barrier for business attraction.”

E.J. Perkins, a policy analyst with Arizona State University’s Morrison Institute for Public Policy, said that the measure wouldn’t prevent lawmakers from changing other parts of the sales tax rate in the future.

“The truth is more nuanced than that,” Perkins said.

Leaders of the campaign for Proposition 204 say the measure would help lure businesses to the state by improving the education system and helping support stronger transportation infrastructure.

“Taxes are important and other things are important, when (businesses) make these relocation decisions, but there is nothing more important than the workforce availability and the level to which it is trained and skilled and knowledgeable,” Cunningham said.

Ann-Eve Pedersen, chair of the proposition’s ballot committee, said that measure would create jobs and make the state more competitive by strengthening its education system.

“I think that it would give Arizona an economic boost and it would give us something to brag about,” she said. “Because I don’t know how many states can say that they have a permanent, dedicated revenue source for education.”

Pedersen dismissed the claim that a higher sales tax would discourage spending.

“The public makes its spending decisions based on what their needs are,” she said. “They don’t make them based on what the sales tax is.”

Linda Gee, a Tucson real estate agent, said she thinks the proposition will help her sell homes.

“I see new families being interested in moving to Tucson who look at the status of our education system and think twice,” said Gee, who submitted an argument for Proposition 204 in the state’s publicity pamphlet on ballot measures.

Dennis Hoffman, a professor of economics at Arizona State University’s W.P. Carey School of Business, said that while Arizona needs to get more dollars into education, a higher tax rate can be a negative for the economy and jobs.

“It’s a balancing act,” he said.

He said that if the measure passes, it would leave the state with a relatively high sales tax rate that might deter spending but that sales taxes don’t tend to be too onerous.

“It’s not the type of tax rate that stifles jobs,” he said.