Cronkite News has moved to a new home at cronkitenews.azpbs.org. Use this site to search archives from 2011 to May 2015. You can search the new site for current stories.

Report gives Arizona high marks for funding of retirees’ health care

WASHINGTON – Arizona was one of the best states in the nation when it came to the annual funding of pensions and health care for state retirees in 2010, according to a national report released this week.

“Widening the Gap,” by the Pew Center on the States, rated states on their funding of pensions and health benefits for public-sector retirees.

Ideally, states would have assets on hand to fund both the annual contribution for each program as well as their liability. An annual contribution is what a state should pay to sustain a program over time, while the liability is the total financial obligation the state has toward the program.

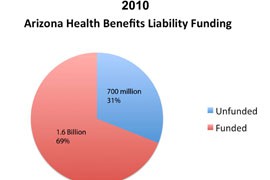

Arizona was the only state able to fund its annual contribution to retiree health benefits in 2010.

The state also had more funding set aside toward the long-term health benefits liability of its retirees than any other state, at 69 percent. The national average for health-care liability funding was just 8 percent in 2010.

“Arizona is the top state in managing health retiree benefits,” said David Draine, a senior researcher for the Pew Center.

Arizona was also able to pay its annual contribution for pensions in 2010, one of just 19 states to do so.

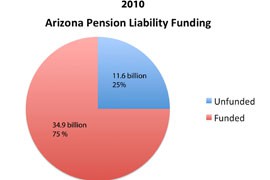

But the state fell short of assets needed to cover 80 percent of its pension liability, the level recommended in the report. Arizona had 75 percent of its total pension liability funded, the report said.

Draine also said that Arizona’s unfunded pension liability was $11.6 billion, just higher than the state employee payroll of $11.5 billion for 2010.

Because its assets fell below the 80 percent threshold and the unfunded liability exceeded payroll, he said, the state got a “serious concerns” grade for pensions. But some other states were far worse.

“While Arizona got the worst grade, they’re not at the scale of another state that has extremely low funding,” Draine said.

Arizona’s ability to pay its required annual contribution for both pensions and retirement health care is the most important thing, said David Cannella, a spokesman for Arizona State Retirement System.

“As long as you have the assets to pay out what you need to, you’re OK,” Cannella said.

Draine said Arizona actually paid more than its recommended amount toward pensions in 2010, with the excess going to its unfunded liability. If it can continue doing that, he said, the state “should be able to begin paying off unfunded liabilities.”

Arizona has taken other steps to manage its pension debt, Cannella said, such as not granting cost-of-living increases and changing retirement requirements for current state employees.

“The numbers are what they are,” said Cannella, adding that Arizona is doing what it can to manage pensions, although some factors are out of its control.

“We’re paying out more than we’re taking in but that’s not unusual,” Cannella said. “The retiree population is increasing and we have a decreasing workforce.”

The report was a follow-up to “The Trillion-Dollar Gap,” a previous Pew study that looked at the national funding gap of state retirement benefits in 2008.

That number had increased to $1.38 trillion in this report, leading to its call for “continued fiscal discipline and additional reforms” for states to regain ground lost since 2008.

A review of state funding for retiree benefits serves an important purpose, but it’s not the whole story, said Jordan Marks, executive director of the National Public Pension Coalition. He said the retirees themselves need to be kept in mind.

“Retirees feel the effects of pension cuts that states make,” Marks said. “But I think that overall Arizona has been a great example of balance and compromise.”

Marks noted that the Pew report is a “snapshot of funds from the economic downturn,” and the pension numbers are not necessarily cause for concern.

“As the economy rebounds, the retirement system will have the money it needs to pay people’s pensions they were promised,” he said.

Cannella said he believes Arizona’s state retirement system is sustainable in the long run.

“The report looks at if the programs are sustainable over time,” Cannella said. “And ultimately, we think they are.”