Cronkite News has moved to a new home at cronkitenews.azpbs.org. Use this site to search archives from 2011 to May 2015. You can search the new site for current stories.

Housing alliance: Bias in handling of foreclosures in minority neighborhoods

WASHINGTON – Banks are neglecting foreclosed homes in minority neighborhoods compared to those in white communities, according to a housing advocacy group that said it will file Fair Housing Act complaints over the supposed practice.

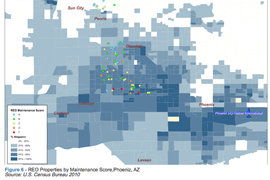

The National Fair Housing Alliance looked at 1,036 foreclosed homes over the last year in nine markets, including Phoenix, and said there were “troubling disparities in maintenance and marketing practices” of foreclosed properties in predominantly black and Hispanic neighborhoods.

It said 73 percent of foreclosed homes surveyed in Hispanic neighborhoods in Phoenix had more than five maintenance problems, compared to 25 percent of foreclosed homes in white neighborhoods.

“Phoenix was targeted (for the investigation) because of their very, very high foreclosure rates,” said Shanna Smith, president and CEO of housing alliance. “The blight that these neighborhoods have suffered from is all the responsibility of the banks.”

But officials at the American Bankers Association said banks “strive to sell foreclosures as quickly as possible,” no matter what neighborhood the house is in.

“Banks operate and are examined under fair-lending and fair-housing laws to ensure equal treatment across all communities,” said Bob Davis, executive vice president for mortgage policy, in an email. “Banks take care of these houses to preserve their collateral regardless of where the property is located.”

But Smith said the report found foreclosed homes in minority communities were more likely to have maintenance problems, be littered with trash, have broken or boarded windows and lack a “For Sale” sign. She said the alliance plans to file racial discrimination complaints with the Department of Housing and Urban Development against several major lenders as a result.

Smith hoped the move would lead lenders to “reach out … to preserve the asset and help the neighborhood.” But, she warned, “If people want to get into lengthy litigation, we’ll certainly have the resources to do that.”

The alliance investigation was partially funded by grants from HUD, which gave fair housing organizations $28 million in October to investigate housing discrimination, according to the department website.

The foreclosed homes were graded on 39 different maintenance and marketing factors, such as curb appeal, structure, damage and presence of professional “For Sale” signs, what Smith called “routine maintenance” of a property.

“We’ve never expected a lender or a bank to put more money into the house than is feasible for the surrounding neighborhood,” she said.

The study looked at 72 foreclosed homes in the Phoenix area, but only those in Hispanic neighborhoods got grades of D or F for maintenance and marketing. Fourteen of the 16 foreclosed homes in predominantly white neighborhoods got an A or a B.

Maryvale was one Hispanic community the alliance looked at in November. Smith said she was contacted by the National Association of Hispanic Real Estate Professionals, which she said was “distressed with the low quality of maintenance.”

Foreclosed Maryvale homes are not kept up but “just left to flip into the hands of the next investor,” said Gail Buck, a founder of the Arizona chapter of the Hispanic real estate group.

“This area of town has suffered a very high level of foreclosure,” she said. “Without owner-occupants, we cannot stabilize the communities.”

Buck said she is actively involved in Maryvale, an area of 30,000 single-family homes that is 92 percent Hispanic. But she disagrees that the problem is solely race-based.

“I don’t think it’s race-based – I think it’s lower-income,” Buck said. But “low income also coincides largely with Hispanic demographics.”

And maintaining foreclosed homes in low-income neighborhoods is the responsibility of real estate agents as well as banks, she added.

“At the end of the day, it’s the real estate professional’s job to push back . . . to let them know this home is not being cared for,” Buck said. “The banks that we represent aren’t triggering the job (of upkeep). We need to push back and make sure that they are.”